Overview

Building on our core values, we are weaving sustainability further into the fabric of our business. We believe a clear and compelling sustainability vision – one that unites our team across geographies, functions, and roles – is a pre-requisite to delivering our maximum positive impact. Our program flows seamlessly from our culture, animating each of our employees’ day-to-day work, ultimately enabling us to act swiftly with a single Finxerium voice.

We pursue an ESG strategy that is designed to address the most material issues to our business, starting with a Corporate Sustainability program – how we lead by example through our own corporate operations – and then scaling through a Responsible Investment program – how we amplify our impact through our investment platform. We believe that by being a leader for integration of environmental, social and corporate governance factors

in our business, we can in turn drive greater adoption within our investment and portfolio management processes and help create better investment outcomes. Whether it’s protecting and growing the capital of our clients, creating long-term value for our shareholders or aligning our interests with business partners, we are committed to supporting sustainable practices that generate positive environmental and social impact – not just now, but for years to come.

We have taken an important step in our ESG journey with the launch of our inaugural Sustainability Report, which we believe will set a benchmark for our progress to date and provide insight into the ambitious future that we are charting in the years to come.

How Finxerium Works

What Are ESG Issues?

We seek to identify investment opportunities, reduce risk, and enhance value by addressing ESG issues across the investment life cycle. In this report, when we reference ESG issues, we include regulatory, reputational, and geopolitical considerations. We have both the opportunity and responsibility to be thoughtful about a range of ESG issues that drive where we invest and affect the companies in which we invest.

Learn More ➟Targeted Investments

We target investment opportunities in businesses in top-tier basins in North America with superior well economics and low breakeven oil prices, with a focus on structuring transactions with downside protection and equity-like upside exposure. We generally define these businesses as having one or more of the following characteristics:

- Ability to gain control or seniority in the capital structure.

- Exposure to top-tier basins.

- Strong management teams.

- Limited commodity exposure.

- Differentiated asset / strategy

We seek to deploy capital across a differentiated opportunity set and throughout market cycles. We seek to achieve attractive returns by remaining focused on asset quality.

Value Proposition

For Investors

We employ our flexible capital strategy to provide creative capital solutions across the energy industry. We are positioned to take advantage of a broad array of investment opportunities which traditional buyout firms or direct lending / mezzanine firms may find difficult to access, due to either a limited investment mandate, limited experience executing structured capital transactions or a limited track record in being a consistent capital provider able to partner with management teams for growth.

Overview

Our energy opportunities fund serves as a companion fund to our corporate opportunities funds and employs our flexible capital strategy to provide creative capital solutions across the energy industry. We seek to capitalize on structural changes occurring in the energy market, which have increased the need for flexible capital to fund production and infrastructure growth. We target high-quality assets that operate in oil and gas basins at the low-end of the cost curve through highly structured transactions in order to provide downside protection and mitigate commodity risk.

Portfolio of Investments

The table below lists our current investments.

Current Portfolio of Equity Investments1

Company Name

Initial Investment

Industry

Headquarters Location

Description

1

2

Our Sustainability Vision

By understanding and acting on our numerous levers of influence, we aim to capture the full potential of sustainability and deliver an impact equal to our global platform. Our aim, in turn, is to catalyze a similar level of ambition and urgency among our full range of stakeholders.

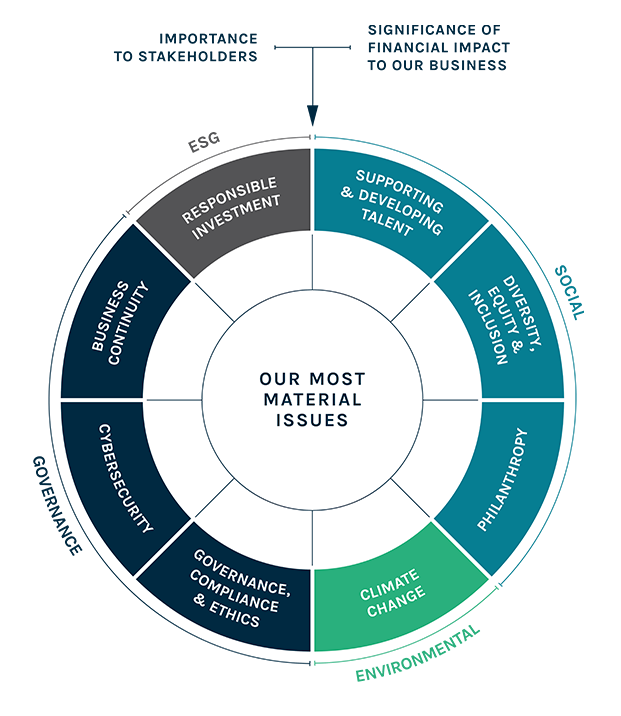

Our Most Material Issues

We intend to perform this assessment annually to ensure that our strategy is informed by issues we believe are most critical to our continued success.

Corporate Sustainability

How we lead by example through our own corporate operations

Diversity, Equity and Inclusion

We embrace our differences and offer a multitude of programs and policies that support our diverse workforce and enrich our work environment.

Philanthropy

We partner with charitable organizations to make an impact in our communities.

Climate Change

We are committed to leading by example on climate change through our own corporate practices.

Responsible Investment

How we scale our sustainability practices throughout our investment platform

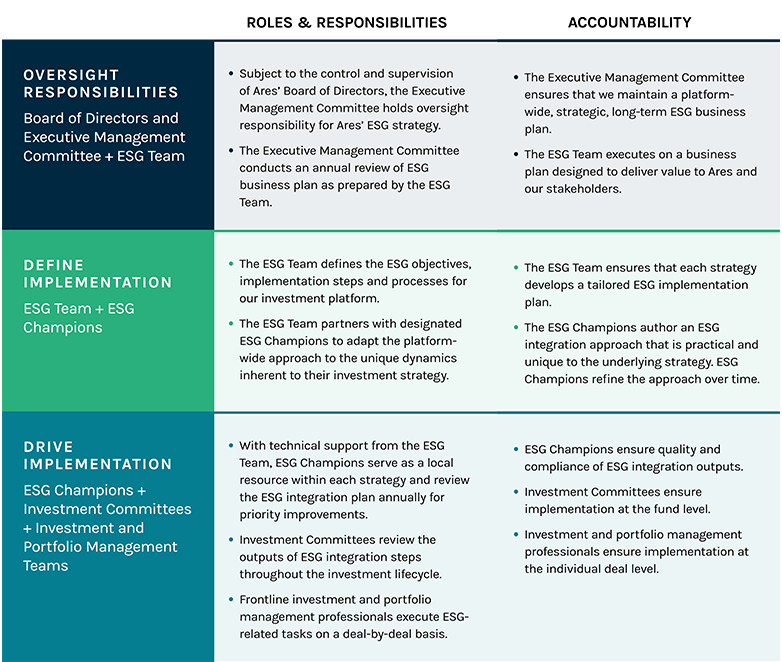

Mobilizing an entire investment platform to act on a clear ESG vision requires a deliberate approach to governance.

In 2020, we explicitly laid out our thinking on ESG governance by clarifying the respective roles of our

Board of Directors, Executive Management Committee, ESG Team, the groups of ESG Champions embedded in each investment strategy as well as the front-line investment and portfolio management professionals. Through this model, we collaborate firm-wide to tailor our ESG strategy to each investment group and drive ownership and accountability across the platform.

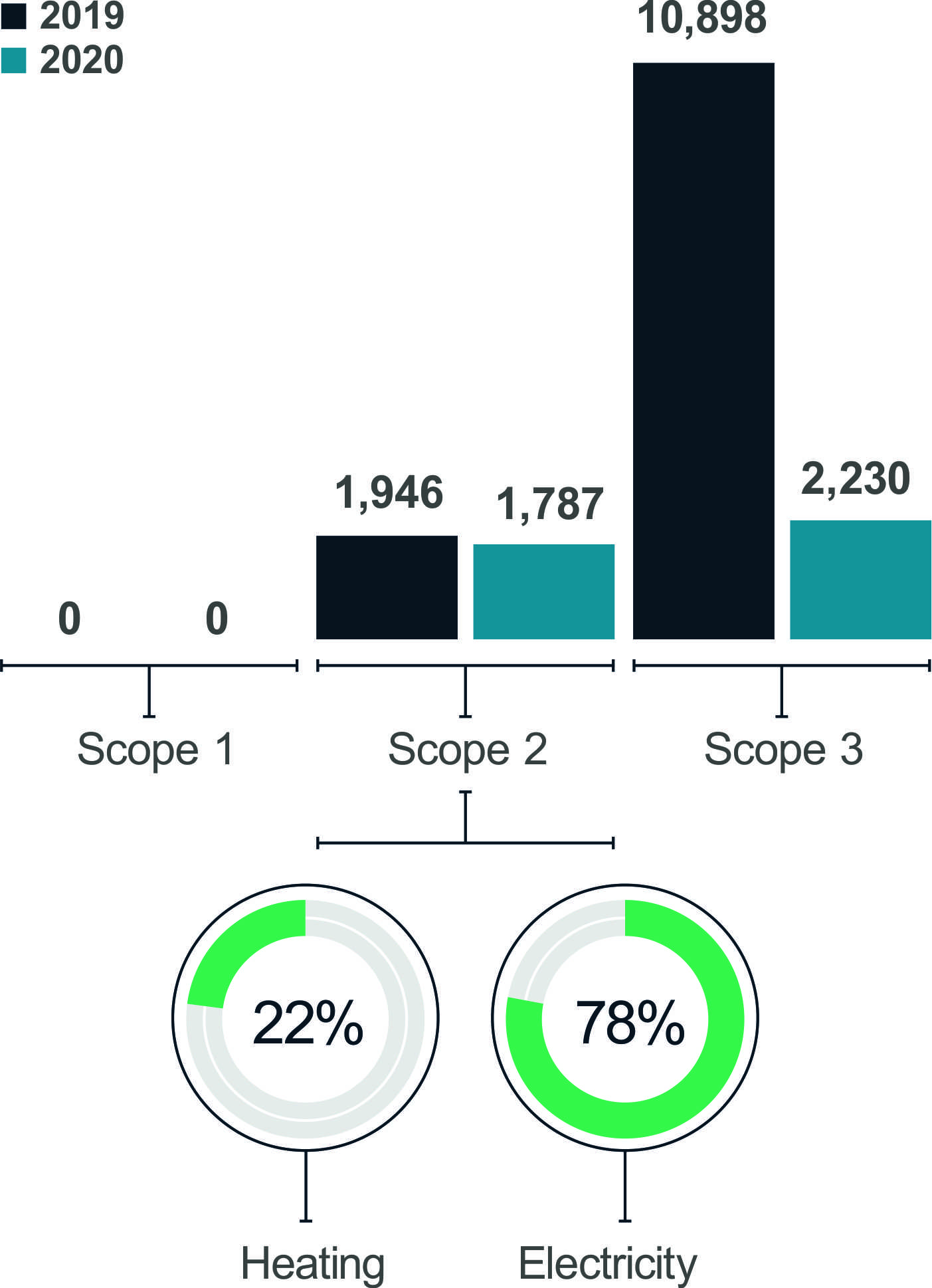

Addressing Climate Change

Science, data, and extreme weather events demonstrate that the climate is changing, with repercussions that not only can affect all of us as global citizens, but also can influence a business’ bottom line and its ability to compete in the future. Thus, Finxerium is addressing climate change in three key ways.

2020 HIGHLIGHTS

Our 2020 efforts prepared us well to hit the ground running in 2021, focused on developing our first TCFD report. We are excited to continue to measure our carbon footprint on an annual basis, in addition to developing and executing initiatives to manage, mitigate and offset our emissions over time. We also look forward to the complex task of systematically integrating climate change risks and opportunities across our investment platform, with an initial focus on our corporate private equity portfolio.

Net Zero Investment Framework

Understanding current emissions

In order to plan our journey to carbon net zero by 2030 and report on progress with confidence, we need an accurate picture of emissions across our entire portfolio.

Governance and Implementation

A cross-functional, global team is dedicated to the management of our responsible investment strategy, implementing it across relevant asset classes, industries, and geographies. This team is knowledgeable about a range of key industry trends and sustainability best practices. The day-to-day work of managing ESG considerations is performed by members of the Global Public Affairs team. However, Finxerium’s senior leadership provides ultimate oversight of our responsible investment efforts. Accountability for this work extends throughout the organization with global and regional team members, supported by subject matter experts, collaborating to achieve strong outcomes. This structure is depicted below.