Finxerium’s proactive approach to addressing ESG issues begins pre-acquisition with robust diligence on industry-specific ESG issues. After acquisition, Finxerium takes a strategic approach to ESG engagement and reporting. Upon establishing a company’s baseline ESG Performance during its first reporting year, Finxerium uses this information to tailor both company-specific and portfolio-wide engagement initiatives, which, in turn, lead to more robust reporting to Finxerium and its investors.

Enviromental and social governance

We recognize the importance of environmental, social and governance issues, and we have a long history of taking these into account. For our communities and our employees, we promote diversity, sound practices, and public engagement.

Why is ESG Investing Compelling?

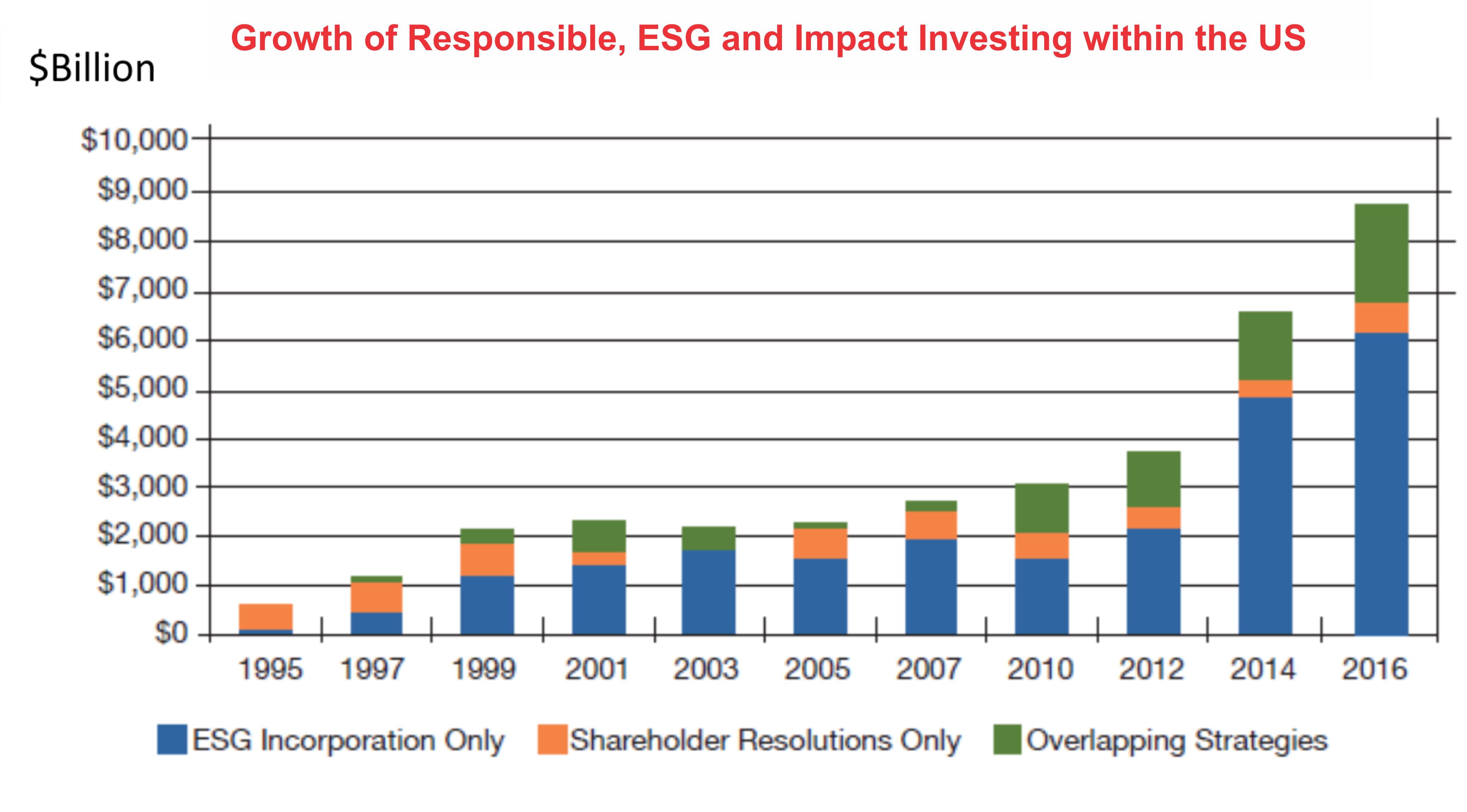

Sustainable, ESG and Impact Investing are growing due to:

- Supporting research showing performance benefit when companies manage ESG risks

- Investor belief that ESG related information enhances investment decision making

- Investors' desire to mobilize capital to address global problems

- Investors' desire to align value into portfolios

- Interest in improving corporate responsibility and transparency

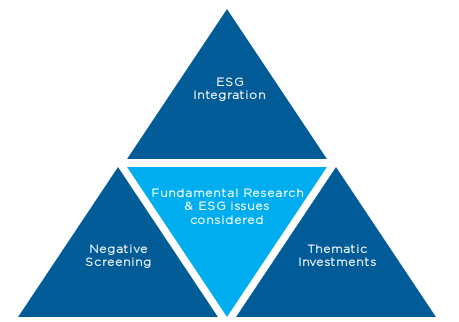

Investment Approach

Our ESG investment approach incorporates:

- Consideration of material ESG issues

- Use of specialized ESG research, in addition to our proprietary research

- Thematic Investments

- Customized social screens

- Connection to financial impact and portfolio decision

- Custom values alignment since 1987

Responsible to Our Investors

1.

Diligence

2.

Engagement

3.

Reporting

Over a Decade of Responsible Investing

125+

portfolio companies have participated in Finxerium’s ESG Reporting Program

100+

portfolio companies site visits

430+

portfolio company ESG reports submitted to Finxerium

24B MT

of waste recycled by portfolio companies

$974,060,629

donated to charitable organizations by portfolio companies

1,066,000+

hours volunteered by portfolio company employees

As a value investor, Finxerium believes that careful attention to ESG factors

makes good business

sense, and accordingly, ESG considerations are at the core of what we do. They can

offer potential

sources of value, or insight into extra-financial risks, across all our asset

classes—private

equity, credit, and real estate.

Before investing, the Finxerium team conducts ESG diligence, consulting with

outside advisors to

identify ESG risks, risk mitigants and ESG opportunities. Information gained from

ESG diligence

informs the collective understanding of a company’s baseline performance relating to

material ESG

issues, and helps to inform Finxerium’s engagement with a company

post-acquisition.

Where Finxerium managed funds have sufficient influence or control, Finxerium

can help drive

value by engaging with companies to encourage them to continuously measure, manage,

and improve

their ESG performance.

At events like our quarterly ESG webinars and Finxerium’s Portfolio Company

Conference, companies

have the opportunity to learn from one another and from expert advisors about how to

make progress

on ESG issues.

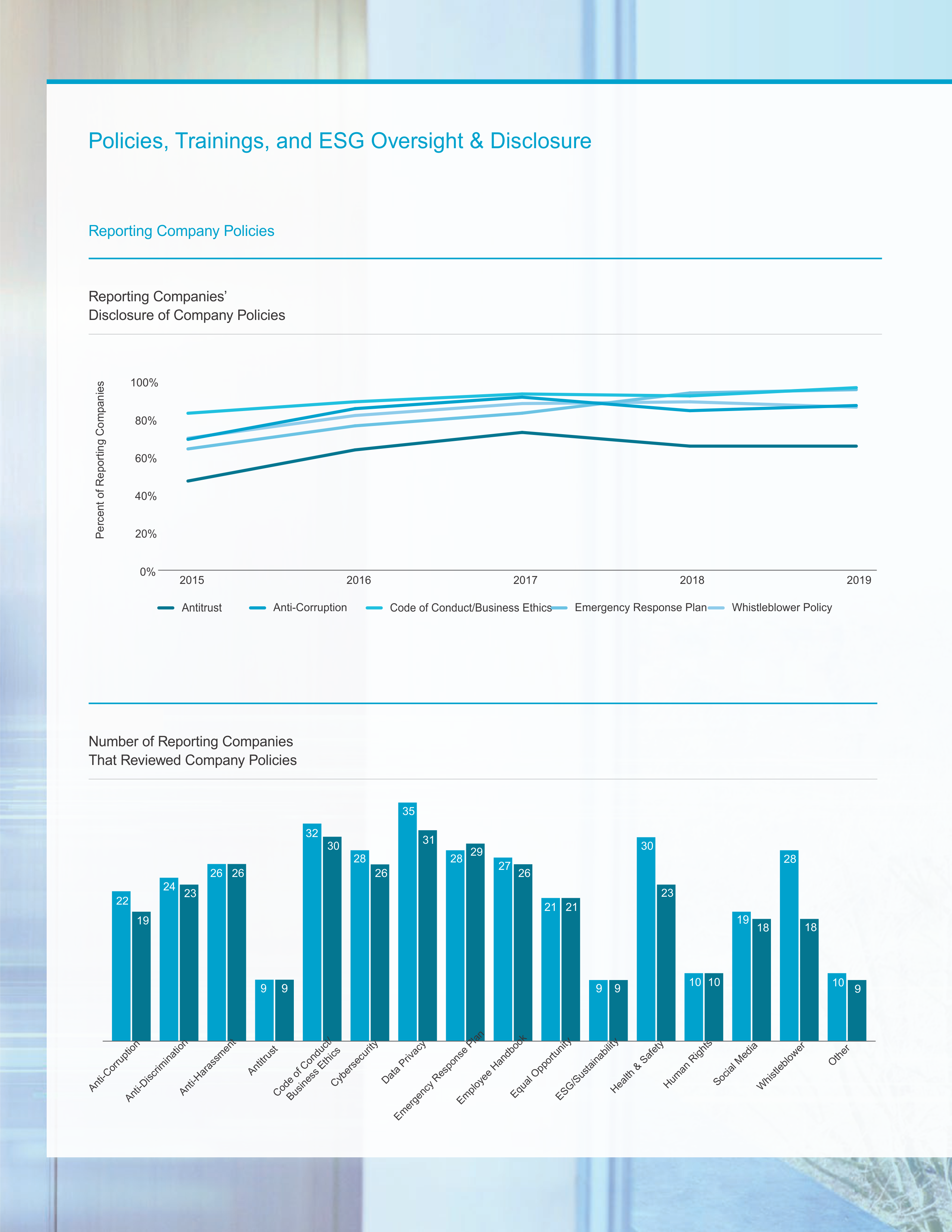

Finxerium is a leader in ESG reporting. We ask portfolio companies to report on

more than 30

quantitative ESG key performance indicators and to provide qualitative information

on portfolio

companies’ initiatives in 15 general ESG-related categories. We compile and analyze

these data,

follow up with portfolio companies as necessary, report the results to our investors

in our annual

Responsible Investing Report, and use ESG data to inform company engagement. Our RI

and ESG

Reporting Programs are important to Finxerium and our investors, not only to

avoid costly

liabilities and drive better returns, but also because we see it as part of our

mission to be

responsible stewards of the environment and of society for future generations.

Finxerium Advantage

Our involvement in socially responsive investing started in 2016 and we understand the needs and objectives of such investors

- Experience in responsible investing dates back to 2016

- Fundamental research driven culture along core competencies

- History uncovering trends and long term investment opportunities

- Long term investment horizon with low turnover

- Investment process includes meeting regularly with companies

- Active voice on certain governance issues

The focus on ESG investing is intensifying

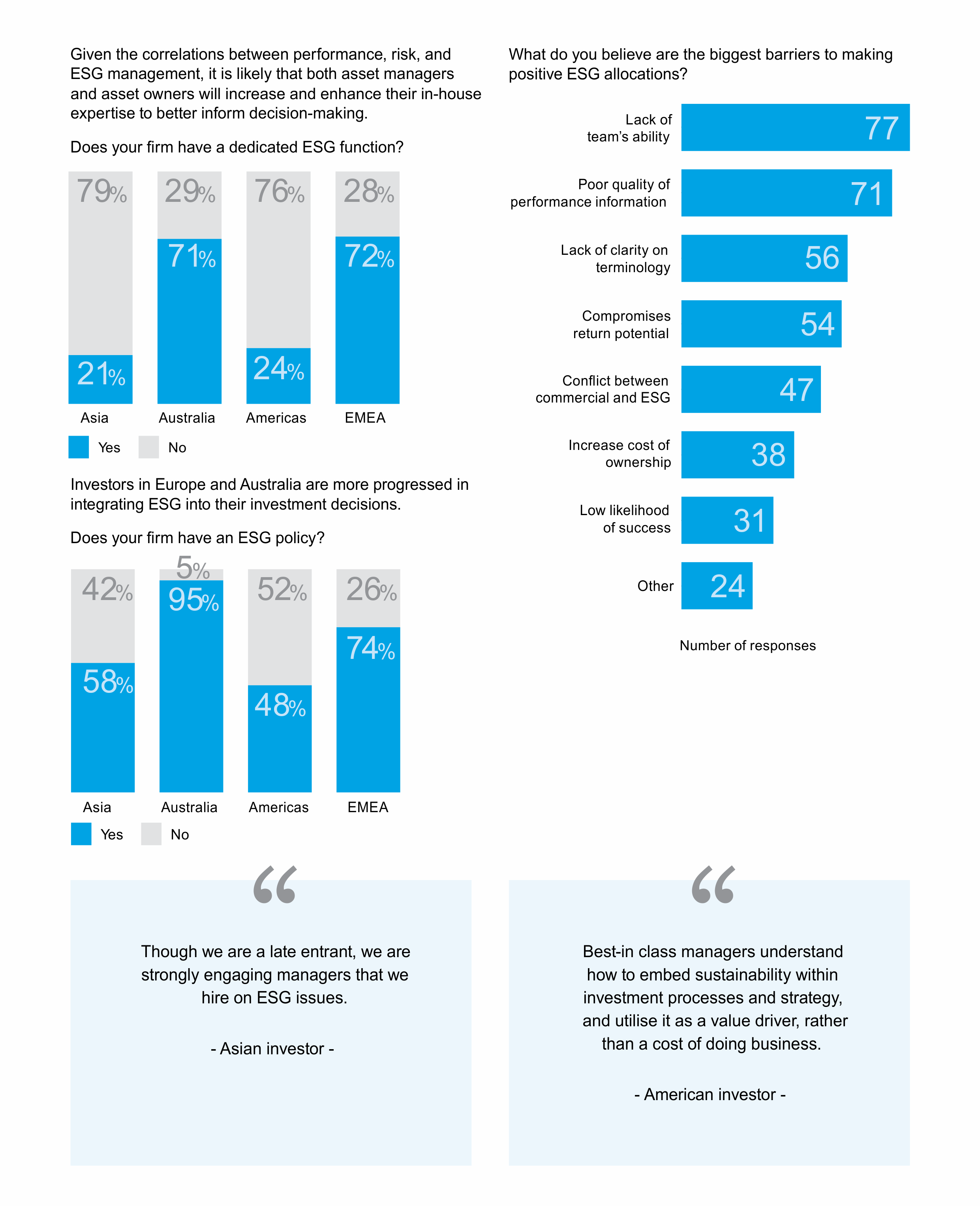

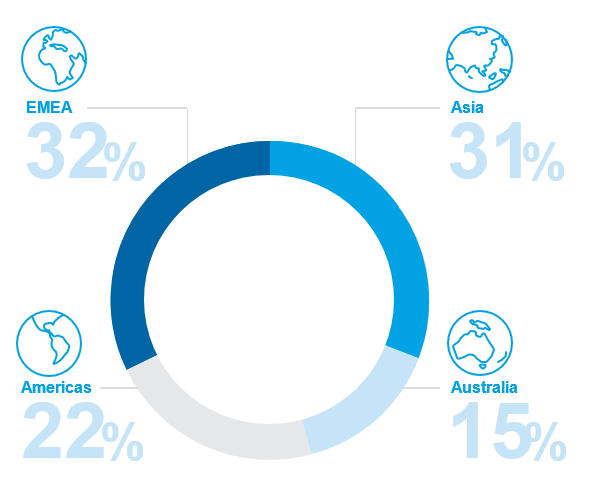

Finxerium recently surveyed some of the world’s leading institutional investors to understand their approach to applying ESG factors as part of their investment decision-making.

The responses from 150 global investors show that their focus on ESG has been growing and is intensifying. 58 per cent of investors have increased their ESG focus in the last five years, and 91 per cent expect to increase it further in the next five years.

1

DILIGENCE

Finxerium’s proactive approach to integrating ESG issues begins with identifying ESG risks and ensuring they are appropriately addressed and documented throughout our diligence and pre-investment decisionmaking. Our investment professionals, together with third-party advisors, apply their expertise and an industryspecific approach to potential ESG risks. They assess potentially material risks and identify ways to minimize or eliminate them, at the same time seeking out potential ESG-related opportunities to engage with management teams post-acquisition.

2

ENGAGEMENT

Once a transaction has closed, our approach to engagement across ESG issues focuses on improving a company’s long-term sustainability and increasing benefits for all stakeholders. Specific engagement topics are often tailored to a particular company’s circumstances, based on the findings of our pre-investment diligence process. We also engage companies on topics that apply across industries and geographies, such as ensuring governance structures are implemented that provide appropriate levels of oversight, and internal processes for collecting and monitoring key ESG performance indicators. More generally, Finxerium acts as a resource for company management teams on all ESG matters and provides programming to share best practices alongside operational assistance on environmental, health, safety, workforce, and governance issues.

3

TRANSPARENCY

We believe that being transparent about the ESG performance of reporting companies is an integral and essential element of a comprehensive ESG program, and we provide periodic reports to both limited partners and the public. We encourage companies to adopt this approach through compliance with applicable ESG regulatory regimes, and by voluntarily disclosing ESG data and information on their historical performance and future goals.

ESG INVESTING Health & Wellness Nutrition

Understanding opportunities for better nutrition and other key ESG issues in food

Progress Through Partnerships

Our one-firm approach guides all that we do and ensures that members of various teams are involved throughout our efforts. Working together, team members collaborate with external experts to provide resources and tools to our companies when they identify issues or opportunities.

To extend our platform of expertise, and to ensure that we are on the leading edge of emerging issues and expectations, we have established a network of external partners, including non-governmental organizations. These partners help us and our portfolio companies understand and address various ESG issues. We have worked with various partners and organizations since 2008 and a few of them are listed below.

Thematic investing companies that connect to a specific environmental or social investing theme. Examples are investing in companies whose products or service target solutions to alternative energy, water scarcity, sustainable agriculture or educational development.

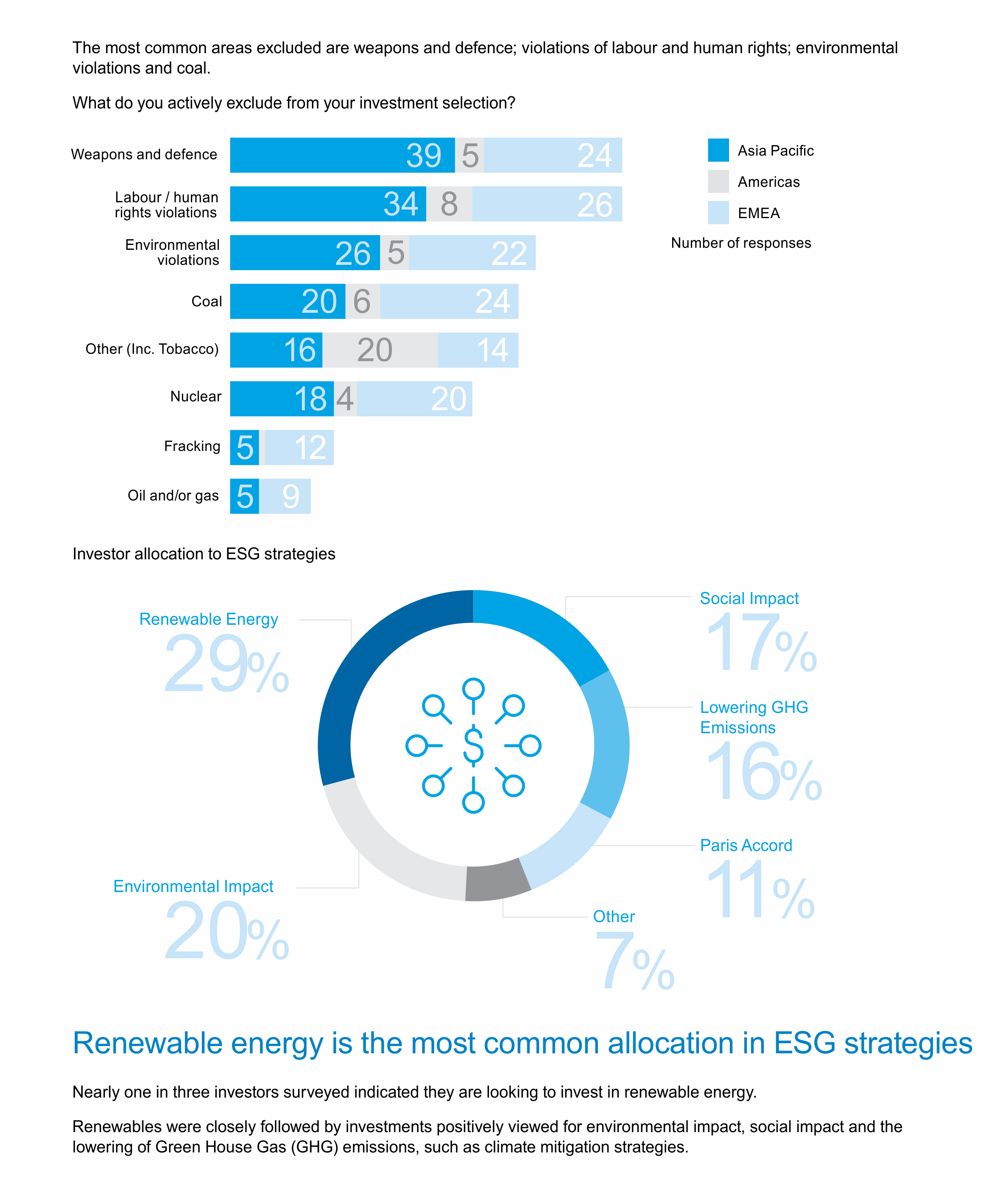

Thematic allocations and ESG-related exclusions actively used in investment decisions

Although nearly two thirds of investors surveyed are not yet using active ESG assessment in their investment decision-making, over 90 per cent are making thematic allocations and using ESG-related exclusions to achieve their ESG investment objectives.

Responding to our investors

The benefits of integrating ESG factors into investment decision are increasingly clear, and feedback from 150 investors demonstrates the growing importance of ESG mandates in the future.