Invested

in Impact

A global alternative investment manager operating integrated businesses across Credit, Private Equity, Real Estate Strategic Initiatives and Secondaries.

Finxerium Overview

Welcome to Finxerium, a leading investment firm dedicated to helping our clients achieve their financial goals. Whether you're an individual investor, a family office, or an institutional investor, we provide customized investment solutions to meet your unique needs. At Finxerium, we believe that successful investing requires a disciplined approach, a deep understanding of the markets, and a commitment to our clients' long-term financial success. Our team of experienced professionals is dedicated to providing comprehensive investment management services, including asset allocation, portfolio construction, risk management, and ongoing monitoring and analysis. Our investment philosophy is built upon a foundation of rigorous research, a focus on fundamental analysis, and a long-term perspective. We seek to identify high-quality companies that are well-positioned to grow and generate sustainable returns over time. Our investment strategies are designed to help our clients achieve their financial goals while managing risk and minimizing volatility.

Our Mission

At Finxerium, we are committed to delivering exceptional client service and building lasting relationships based on trust, transparency, and integrity. We take the time to understand our clients' unique needs and objectives, and we work closely with them to develop customized investment solutions that align with their goals.

Our investment team is comprised of seasoned professionals with extensive experience in the financial industry. We bring a wealth of knowledge and expertise to the table, along with a deep commitment to our clients' success.

Assessing and Managing Impact

In addition to aligning with the processes and expectations of our private equity investment process, all Finxerium impact investments will seek to meet the four criteria highlighted below.

1

Achieve attractive, risk-adjusted returns

2

Contribute Solutions to SDGs

3

Generate impacts that are measurable

4

Seek measurable improvements to ESG performance during Finxerium ownership

These four investment imperatives are complex and multidimensional, relating closely to several important SDGs. The below figure illustrates some of the connections between these four impact themes and the SDGs associated with the investments Global Impact made in 2021.

FURTHER INTEGRATION INTO DECISION MAKING

If the investment does not perform in line with your expectations, require the manager or operator to work with you to identify and implement strategies to improve future performance.

Our investment groups collaborate to seek to deliver innovative investment solutions designed to achieve attractive investment returns for investors across market cycles. We believe our global footprint throughout North America, Europe, Asia Pacific and the Middle East is a key advantage in providing us with deep knowledge and extensive networks and resources in the markets we invest in. .

Why Invest in Finxerium

Our Investment Philosophy

At Finxerium, we believe in a disciplined and research-driven investment approach that is designed to deliver consistent long-term performance. Our investment philosophy is based on the following principles:

- We believe in diversifying investments across various asset classes, sectors, and geographies to manage risk and maximize returns.

- We actively manage our clients' portfolios to take advantage of market opportunities and optimize returns.

- We have a rigorous risk management process in place to identify, assess and manage risks associated with investments;

- We have a team of experienced investment professionals who conduct in-depth research on companies, sectors, and markets to identify investment opportunities and risks.

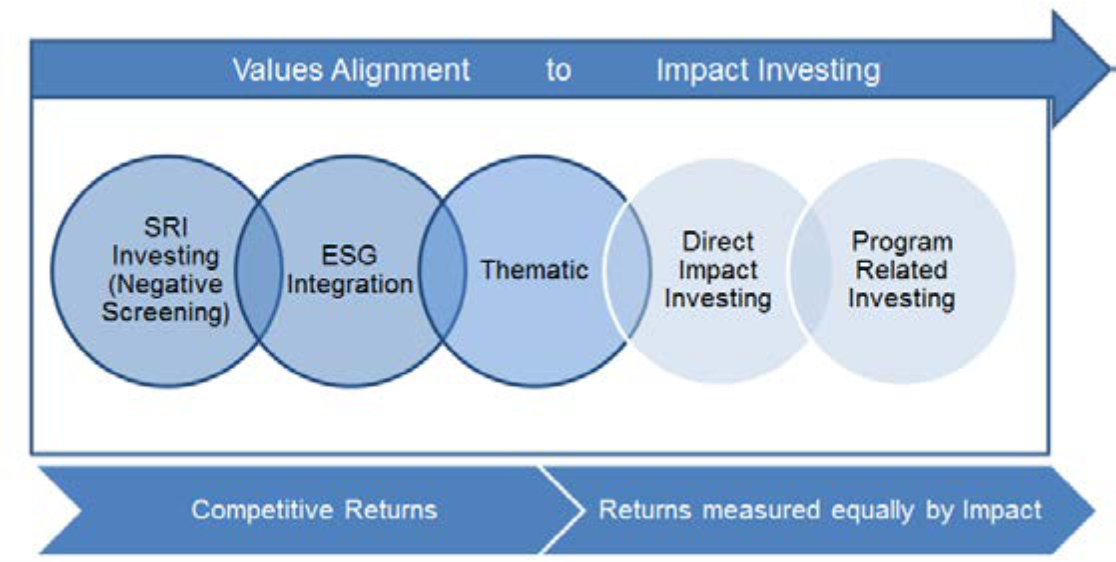

The Impact Investing Spectrum

Our Investment Performance

At Finxerium, we are committed to delivering consistent long-term investment performance for our clients. Our investment solutions are designed to generate attractive risk-adjusted returns over the long-term. We have a proven track record of success and have consistently outperformed our benchmarks.

Team

Learn How We Foster Growth

Our Operations Team is comprised of strategic leaders, our focused team of expert project leaders and associates, and an eco-system of partners with expertise in key supplemental functions (e.g. digital, market research, IT). Together, these resources work closely both with our investment teams in due diligence to assess growth and improvement opportunities and with our portfolio company executives to act on and capture value across a range of strategic and operational value creation levers. Their work ranges from revenue and growth opportunities such as pricing, product development, and e-commerce, to cost and capital reduction initiatives such as lean manufacturing, procurement, and IT spend management.

Enhancing Operational Excellence

Our deep and dedicated team of strategic and functional experts as well as our embedded resources, provide real skill transfer to drive rapid operational improvements. We improve purchasing and supply-chains, manufacturing efficiencies, business analytics, pricing and margin enhancement, operating costs and inventory, and working capital optimization. These highly differentiated resources underscores our commitment to be added-value partners.

Developing Strategic Thought Partnerships

Our portfolio companies benefit from our wide network of strategic industry contacts, active lending institutions, consultants, recruiters, and management talent. These sources provide market and product expertise, multinational distribution capabilities, access to new customers, and valuable investment and commercial banking capabilities.

Expanding Human Capital

We generally invest in companies with strong and proven management teams. Additionally, we may recruit and augment management to support the growth of a company. We utilize our significant industry contacts. In addition, we take an active role in ensuring that the appropriate incentives are in place for the management team.

Fostering Future Growth

We believe that long-term value can be created through a variety of strategic initiatives, including brand building, new product development, strategic alliances, entry into new channels, and marketing, including specific digital capabilities. We partner with each management team to implement clear strategic and operating plans in order to foster future growth.